How to Prepare a Rocking Pitch Deck

This post synthesizes the information that an excellent Pitch Deck for investors should include. You can also use it to prepare a document with different objectives, for example, to get more team members on board or find partnerships.

I hope the information will help you to be able to grow your Web3 project.

Document recommendations

Look & Feel

- Format: slide format is the best option for the pitch deck.

- Template: choose an eye-catching design and adapt it to the project brand image.

- Visuals: use images, illustrations, graphics, diagrams, and bullet points.

- Uncluttered content distribution: each slide “needs to breathe.” Include further information in the appendix.

- Clean design: respect the template Pantone colors, fonts, sizes, structure, and elements position.

Content

- Simplicity: use easy-to-read, direct, and short sentences to describe each idea.

- Conciseness: avoid repeating the same concepts or ideas from one slide to another.

- “The 3 points rule”: the set of 3 are more memorable for the human mind.

- Use of standards: there are specific contents that investors want to find in the document.

Story Telling

- Tell a story: the setting, the plot, the conflict, and the resolution. Human engagement is easier achieved by telling stories.

- Connect and compare ideas along the deck.

- Use personal examples or make the story yours, as if you were the main character who has the problem the startup is solving.

- Use descriptive sentences so people can visualize other people and specific situations.

- The tone of voice: make it friendly and emotional (exciting, not sad). You can also use humor and anecdotes to create a closer atmosphere.

The Must-Have Content Topics

1. The Problem

The setting of the whole story

Try to make it impactful and descriptive.

May use pictures.

It is a perfect moment to open the story making it yours as if you were the one who has the problem. Or you can also talk about a close friend or family of yours.

The format can be the title of worldwide press news.

Use numbers: total volumes or percentages of people affected.

2. The Solution

Use an Easy formula to describe your UNIQUE VALUE PROPOSITION

We help the WHO target audience

to WHAT get something done, solve a problem, cover a need

by HOW service or product

Examples:

Shopify helps eCommerce business owners who don’t have the digital know-how to open and manage their own online business by offering a simple, step-by-step platform.

Uber offers everyone who needs a drive the convenience of an app to ask for it without looking for it at a fixed price.

3. Right Moment

Use FOMO: Explain the reason for choosing this exact moment

- Industry’s tendencies: global changes, new problems arise.

- Kind of industry: atomistic/ fragmented or hight-mediated market.

- Social and/ or individual changes.

- Macroeconomic or global changes and tendencies.

- New needs arise.

- Paradigm change (for example, new generations preference for living experiences more than owning things)

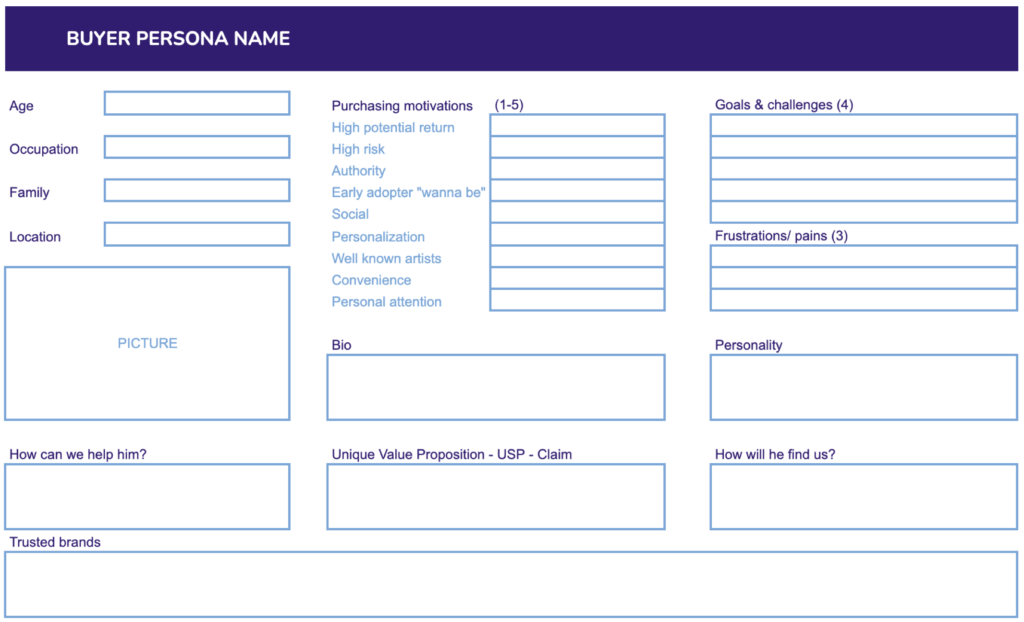

4. Buyer Persona

Name your persona and Introduce her/him to the audience

- A buyer persona is a detailed description of someone who represents your target audience. This persona is fictional but based on deep research of your existing or desired audience. You might also hear it called a customer persona, audience persona, or marketing persona.

- It is not essential, but it will help potential investors better understand your proposal. And it will make everything more personal and visual.

It is very constructive to have the whole team participate in building it so that everyone will empathize and focus.

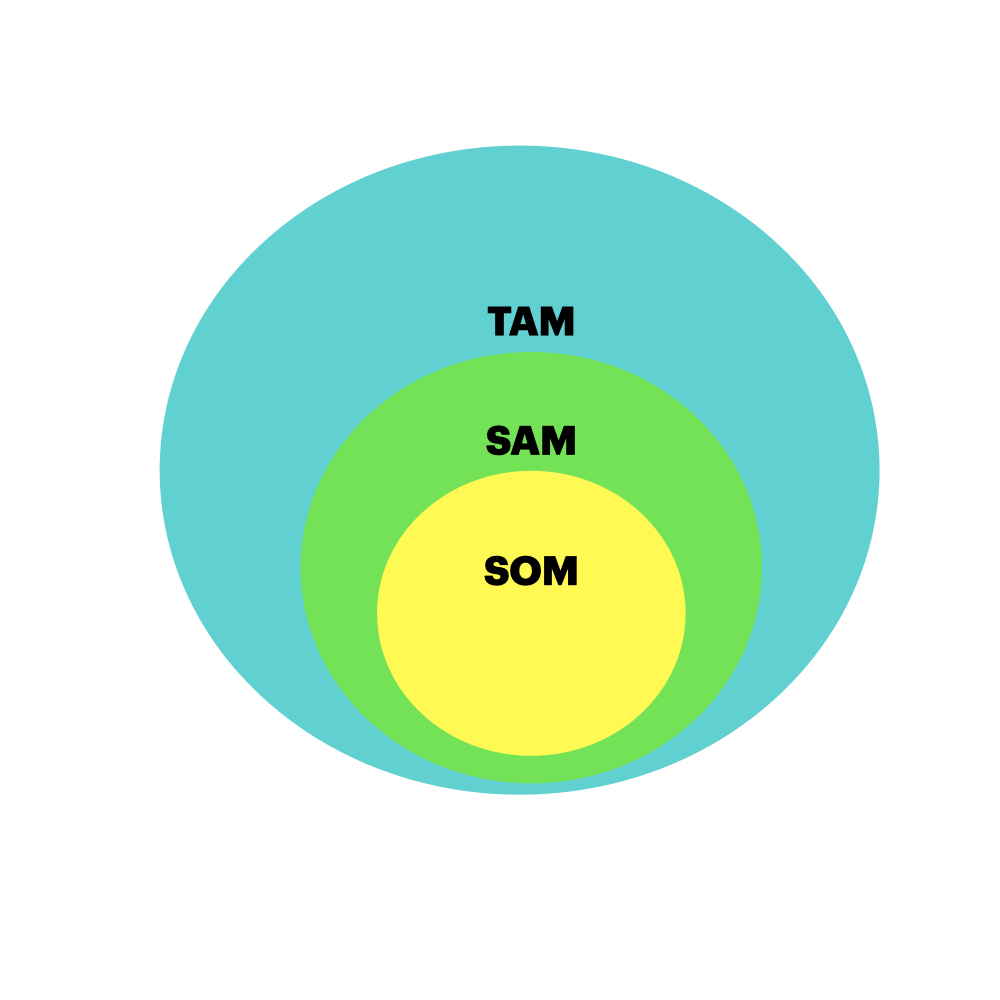

5. Market Size

Market metrics. monetary value

- Total Available Market: total market size.

- Serviceable Available Market: market segment we can reach based on our business model—the portion of the market we can serve.

- Service Obtainable Market: market share we can obtain based on our business plan and company resources—the portion of the market we expect to serve.

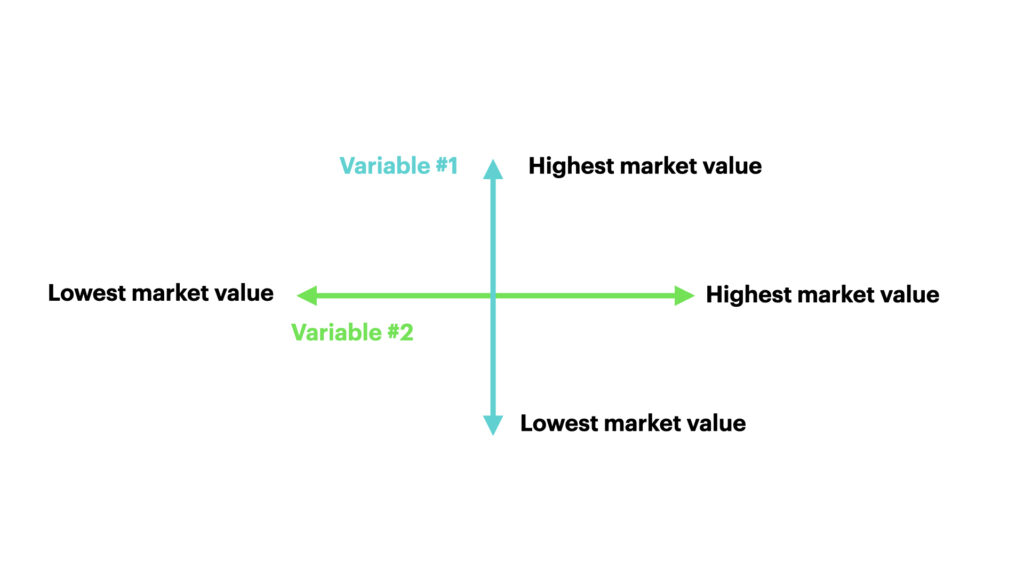

6. Competitors

Map the market based on 2 key variables

7. The Product or Service

Descriptive information about the product/ service and its development

- Features description: technology, pricing, distribution.

- Competitive advantage

- Product development: MVP. How you plan to test your product or service solution with the least effort that allows you to validate the idea.

Uber’s first draft started as a mobile app solely used by the founders and their friends. Users needed to request access from the founders to join the app.

Netflix’s MVP operated on a model whereby movies were sent by mail, not online.

8. Validation or Traction

Validate product-market fit

Identify KPIs to confirm that your idea works. It depends on each product and market, but some important ones are:

- Conversion rates (from total audience reach)

- Repeat purchase

- Lifetime value

9. Business Model

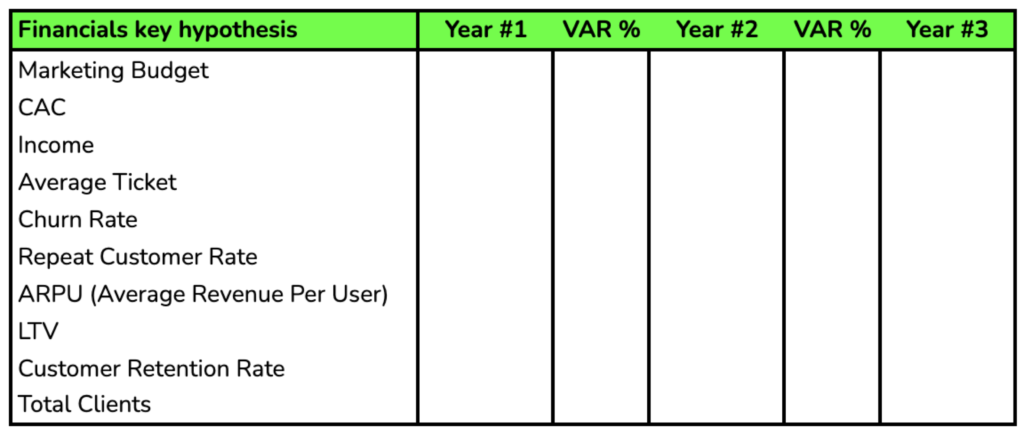

KPI’s and projections (Check definitions and formulas on annexes)

10. Levers of Growth

Plan to scale up

- Targeting new segments

- Reaching international markets

- Product or services upgrading or upselling

- Launching new products or services

11. Financials

Financing plan: validations & hypothesis

- P&L

- Balance Sheet

- Cash Flow

- Cap Table

12. The Team

The who slide

- Team of Founders: it is essential to have a core team expert in the critical fields of the startup. Include their know-how, prior experience, and achievements.

- Board of Advisors and Mentors: well-known and recognized professionals to advise the core team.

13. Funding

What are you asking for

- When you are asking about fundraising, it is essential to include the following information:

- Amount of money you are willing to raise

- Valuation of the company

- The plan for that money raise: uses of it and goals you are planning to achieve

- The main goal of a pitch deck is not always fundraising but having first contact with potential investors and partners and getting helpful feedback about the project.

Is there anything missed? What else would you include? Please, leave a comment with your impressions. And feel free to contact me if you need help with your marketing strategy!

Download a pdf presentation containing all the content here. Enjoy it!

Below, you will find some annexes with applicable documentation to work on the pitch of your web3 project:

Annexes

You can also download a pdf with the document presentation here

Buyer Persona Template

Buyer Persona Google Sheets Template

Some Business Model KPI Definitions & Formulas

- CAC: Customer Acquisition Cost (cost of marketing and sales efforts to acquire a new customer).

- Average Ticket = total sales over a given period/ number of customers

- Churn rate: % of customers lost over a certain period (month, quarter, year…)

- Repeat Customer Rate = total of repeat customers (who purchased 2 or more times) / total of paying customers.

- ARPU (Average Revenue Per User) = income / number of users

- LTV (Life Time Value) = ARPU X (1/ Churn). It is used to predict the value of future income attributed to the customer during the entire relationship.

- Customer Retention Rate = (Customers at the end of the period – new customers) / customers at the beginning of the period

Some Financial Concepts and Definitions

- P&L: the Profit and Loss (P&L) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. These records provide information about a company’s ability or inability to generate profit by increasing revenue, reducing costs, or both.

- Balance sheet: is a financial statement that reports a company’s assets, liabilities, and shareholder equity. The balance sheet is one of the three core financial statements that are used to evaluate a business. It provides a snapshot of a company’s finances (what it owns and owes) as of the date of publication.

- Cash flow is the movement of money in and out of a company. Cash received signifies inflows, and cash spent signifies outflows. The cash flow statement is a financial statement that reports on a company’s sources and usage of cash over some time.

- Cap table: a capitalization table is a spreadsheet or table that shows the equity capitalization for a company; the breakdown of a company’s shareholders’ equity.

References

https://sixads.net/blog/value-proposition-examples/

https://www.investopedia.com/terms/c/capitalization-table.asp

https://www.slideshare.net/PitchDeckCoach/

https://apexlabs.ai/post/how-to-build-an-mvp

https://www.failory.com/pitch-deck/machine-learning

https://drive.google.com/drive/u/0/folders/1M9dWi8H4ElzUbpe7QGRmr7V5FzSI8ix4

Pitch Deck Examples:

https://drive.google.com/drive/u/0/folders/1829aFXXKdmzP0eWr2vDmsrzS34D5gHKz

Leave a Reply

You must be logged in to post a comment.